Supporting Financial Wellness Beyond the 401(k): Why Financial Stress Is a Workplace Matter

A common misconception among employers is that high earners are financially stable. But as Mamie Wheaton, director of financial planning at LearnLux, points out, that isn’t always the case. “High income doesn’t necessarily equal peace of mind. Financial stress at any income level can lead to burnout, disengagement, and even turnover,” she said.

Another common misconception: thinking that offering a 401(k) checks the box on financial wellness. In reality, employees are juggling far more immediate concerns, like credit card debt, student loans, or childcare costs. “If someone can’t manage today’s financial stressors, retirement planning is often the last thing on their mind,” Wheaton said.

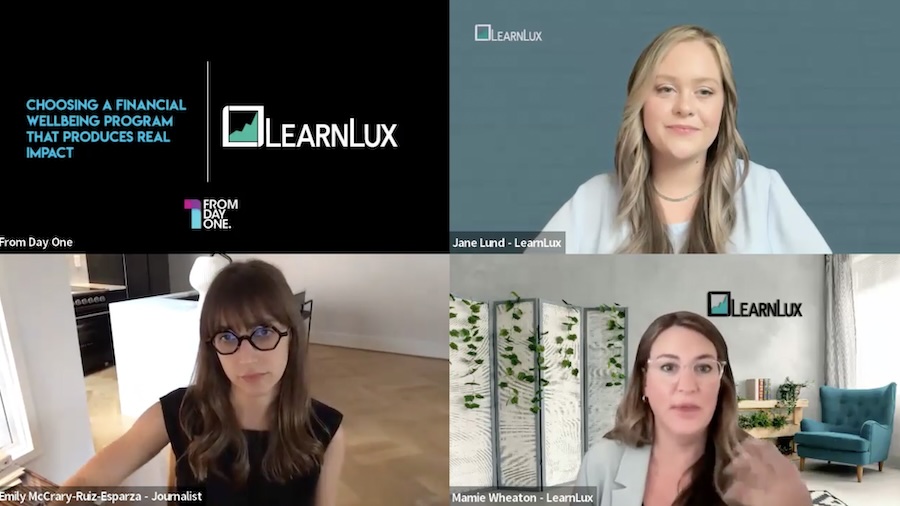

She and her colleague Jane Lund, who leads regional sales at LearnLux, a financial well-being platform tailored to individual needs, presented a From Day One webinar on how employers can support financial wellness beyond just retirement plans. In it they discussed the very real implications of financial stress on employee retention, engagement, and productivity.

Uncovering the Source of Financial Stress

Employees don’t always know what kind of help they need, or how to ask for it. “People often feel shame about their financial stress, especially if it’s tied to family building, life changes, or illness,” Lund said. Those needs often show up in hardship withdrawals from retirement accounts, upticks in personal loans, or rising absenteeism. “Sometimes all three,” she said.

For HR leaders, this presents a challenge. Financial struggles are seldom obvious, but the downstream effects–like absenteeism, disengagement, and attrition–are very real. As Lund put it, “You don’t really see people raising their hands saying, ‘I need help,’ so how are leaders supposed to know what to prioritize?”

Even when employees do schedule a call with a financial planner, like those at LearnLux, they might open with a question about retirement planning, but the real issue could lie elsewhere. That’s when licensed, certified planners like Wheaton dig deeper, looking for the root problem, so they can help employees feel empowered to make better decisions for themselves. Sometimes a single conversation can make a difference, while others will need regular touchpoints over weeks or months to find their footing. And for everyone, these needs may change over time.

Why Financial Wellness Is a Workplace Matter

The implications of financial wellbeing are closely tied to safety, productivity, and retention. One LearnLux client, a construction company, launched a zero-injury initiative and discovered through surveys and conversations that employees’ financial stress was a key factor. “We see that a lot in frontline workforces,” Lund said. And not just in blue collar workplaces, the same is true in higher-earning industries, like healthcare.

By introducing financial wellness support, the company helped employees stabilize their personal finances, which in turn supported their safety goals. Retention improved, too. Based on their annual survey, “about 79% of employees who have used LearnLux for three months or more say they’re more likely to stay at their current job,” Lund said.

“If we can be there to help new employees start off on the right foot, it’s going to help with retention,” Wheaton added. “It’s also going to help reduce 401(k) loans, credit card debt, and overall stress at work.” Small changes that add up to a healthier, safer, and more resilient workforce.

Editor’s note: From Day One thanks our partner, LearnLux, for sponsoring this webinar.

Emily McCrary-Ruiz-Esparza is an independent journalist and From Day One contributing editor who writes about business and the world of work. Her work has appeared in the Economist, the BBC, The Washington Post, Inc., and Business Insider, among others. She is the recipient of a Virginia Press Association award for business and financial journalism. She is the host of How to Be Anything, the podcast about people with unusual jobs.

(Photo by Puttachat Kumkrong/iStock)

The From Day One Newsletter is a monthly roundup of articles, features, and editorials on innovative ways for companies to forge stronger relationships with their employees, customers, and communities.